05/08/2023

A Guide to US Biotech Investing

betting on drug development phases

Today I am collaborating with Reasoned Speculations to clear out some of the fog in the drug development pipeline, and the basics of risk/reward at each stage of the process. None of this is investment advice, and biotech investing is an unreasonably sophisticated game even among smart investors. Most people won’t touch it – and that’s why it offers some of the most interesting trades you’ll ever find.

R&D

R&D refers to the pharmaceutical research and development of new medicines.

R is research. Research in the drug life cycle is mostly drug discovery and bit of preclinical.

D is development. Development in the drug life cycle is preclinical and clinical trials. The purpose of drug development is to determine the efficacy (benefit) and safety (risk) as tied to the body’s exposure to the drug (pharmacokinetic profile).

The process is three fold

Research & Discovery – during this stage, scientists want to understand the disease and select a target (usually a receptor site on a cell) that can potentially be affected by a drug molecule.

This can involve screening large numbers of compounds for potential efficacy and identifying potential targets for treatment.

Preclinical Development – during this stage, scientists conduct extensive testing on cell cultures and animal models to evaluate the safety and efficacy of the drug candidate.

This stage includes toxicology and pharmacokinetics studies.

Clinical Trials – after preclinical testing, if the FDA issues an Investigational New Drug (IND), the drug candidate moves on to clinical trials.

These trials are conducted in humans to evaluate safety and efficacy.

The IND

Before you can start Phase 1 clinical trials with an experimental medicine, you must file an IND with the FDA. You need to submit an IND if you are testing a New Molecular Entity, or a known drug for a new indication.

Investing in drug development companies can be challenging for several reasons:

High Failure Rates: Drug development is a highly complex and risky process with a high rate of failure. Developing a new drug from discovery to market approval is a lengthy and expensive journey that can take over a decade and cost billions of dollars. Despite extensive preclinical and clinical testing, many drug candidates fail to demonstrate sufficient efficacy or safety, leading to costly setbacks and potential loss of investment.

Regulatory and Compliance Challenges: Drug development is heavily regulated by government agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Companies must navigate complex regulatory pathways and meet stringent requirements for safety, efficacy, manufacturing, and quality assurance. Regulatory approvals can be time-consuming and uncertain, making it difficult to predict timelines and outcomes for investment purposes.

Long Development Timelines: The drug development process involves multiple phases of clinical trials, each requiring significant time and resources. It can take years to complete these trials and gather sufficient data to assess the safety and efficacy of a drug candidate. This lengthy timeline prolongs the period before potential market approval and revenue generation, increasing the investment risk and reducing liquidity.

High Research and Development Costs: Developing a new drug requires substantial investment in research and development activities, including preclinical studies, clinical trials, manufacturing scale-up, and regulatory submissions. The costs associated with these activities, coupled with the high failure rates mentioned earlier, make drug development an expensive endeavor. Investors need to consider the financial burden and assess the company's ability to fund its development pipeline.

Competitive Landscape: The pharmaceutical industry is highly competitive, with numerous companies vying to develop breakthrough therapies and capture market share. The presence of established pharmaceutical giants and well-funded biotech firms can make it challenging for smaller drug development companies to stand out and succeed. Investors need to carefully evaluate a company's competitive advantage, intellectual property, and market potential before investing.

Uncertain Revenue Streams: Even if a drug successfully reaches the market, commercial success is not guaranteed. Factors such as pricing pressures, reimbursement challenges, competition from generic or biosimilar alternatives, and evolving market dynamics can impact the revenue potential of a drug. Investors need to assess the market landscape, patient access, and pricing strategies to evaluate the commercial viability of a drug candidate.

Given these challenges, investing in drug development companies requires thorough due diligence, an understanding of the risks involved, and a long-term perspective. Diversification of investments across different stages of drug development, therapeutic areas, and companies with promising pipelines can help mitigate some of the risks associated with investing in this sector.

Today I am collaborating with Reasoned Speculations to clear out some of the fog in the drug development pipeline, and the basics of risk/reward at each stage of the process. None of this is investment advice, and biotech investing is an unreasonably sophisticated game even among smart investors. Most people won’t touch it – and that’s why it offers some of the most interesting trades you’ll ever find.

Key Considerations

Biotech is a risk-on investment. Small companies struggle and often fail; investing in a conventionally diversified basket of biotech still poses dramatic risks.

Many biotechs trade at or below their cash position. While this is a positive sign in other industries, in biotech that cash will quickly be spent on R&D and is generally irrelevant unless the company is ceasing research.

Typically, the ‘best’ time to invest in biotech is during Phase II. Phase II determines whether the drug has a reasonable efficacy/chance of approval. Investing earlier is more of a moonshot, and investing later lowers your potential return.

Phase II approval is no guarantee of drug approval, and can easily have worse results than Phase III.

Investing in biotech depends heavily on the target market. Some markets, such as cancer or Alzheimers, are known to be biotech killers. A drug success in those markets would offer substantial upside, but understand that it’s a low-probability endeavour.

Probability Analysis:

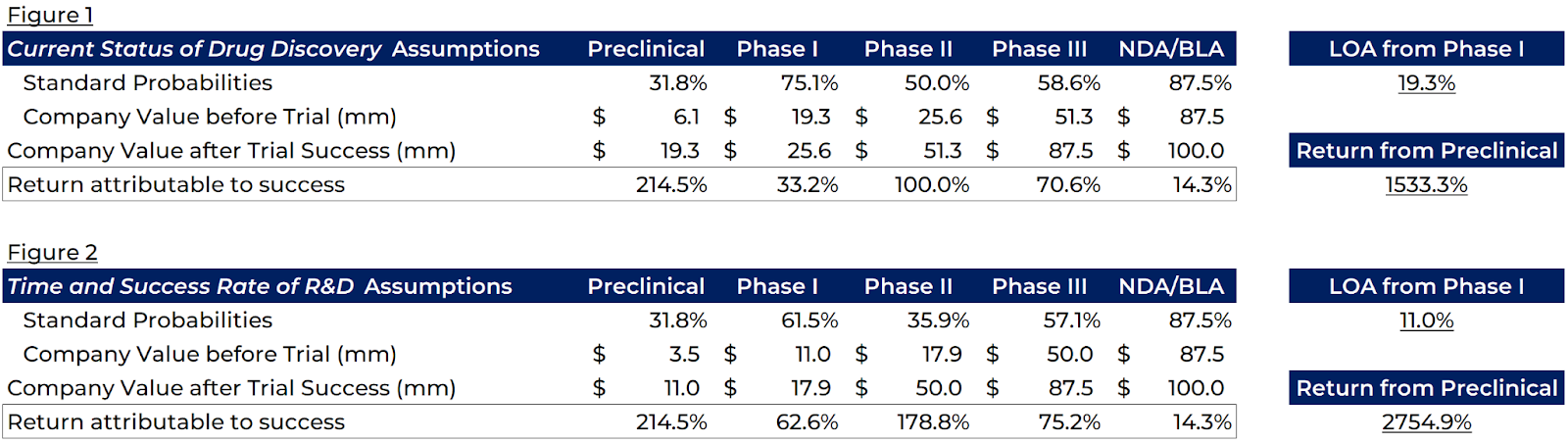

Let’s consider a quick case study of drug approval rates and valuations. Take a public company BasicBioTech that has a Drug XYZ. Drug XYZ, if approved, is worth 100mm exactly, and Drug XYZ is the only product of BasicBioTech. Below are two tables, with different Probability of Approval assumptions for each stage from Preclinical all the way to full approval. The sources for these assumptions are at the bottom of this writeup.

As we pass each step of the approval process, we reduce the speculative risk of the investment and draw closer to something that has potentially real-world applications.

Being an early investor in a successful drug, from the preclinical stage, offers the highest risk and return. At that point, it’s a moonshot, a gamble rather than a real investment. Phase I adds little information to the market, and thus offers lower return. Phase II is the real determinant of if a drug has a shot at hitting the market, and is an investor’s favorite time to enter the market. Per the math above, holding from Phase II to full approval can 4-5x your investment. Just holding through Phase II and selling in Phase III still offers 2-3x your investment back. Phase III offers lower return but also less risk; and as expected, the final regulatory approvals offer little return since the high-risk trials are complete.

The Likelihood of Approval starting from Phase I differs pretty substantially from Figure 1 at 19.3% to Figure 2 at 11%. With a lower probability of approval, and ‘knowing’ as we do that BasicBioTech is worth 100mm, we see the theoretical returns in Phases I-III change pretty dramatically. Similarly, for a drug attempting to treat a complex disease with a lower approval rate, you’ll see lower valuations early on as the market assumes it’s just going to be another failure. As information is added through trials, the company value spikes substantially.

I find these tables to be a great framework for understanding biotech as a generalist investor. Biotech offers dramatic returns (2,700%+ from preclinical to approval per Figure 2) and complex risks (only an 11% approval rate per Figure 2). You’re unlikely to pick a biotech investment in preclinical and hold it all the way to market. However, entering during Phase II or Phase III, betting on just one clinical trial result, is a less complex game and still poses an attractive risk-reward. Unlike other businesses, it’s quite easy to make a narrow biotech bet. These stages will take 7+ years on average, and speaking to management and understanding the rhythm of the business over that time frame can make all the difference in a competitive public market.

The pie charts below disaggregate the return into each stage of the process. Phase II and Phase III clearly make up a majority of early-stage biotech return, and it’s easy to see why investors tend to ignore the earlier stages in favor of a Phase II entry point.

What does it Matter?

You may be wondering - okay, I get the idea on phases and all, but is this really relevant? How common are these bets?

investments was going through, and is going through, the same clinical process I outlined above. Most biotech investments worth less than $5 billion have no profits, as cash is cycled back into R&D and operations before reaching the investor. No company pursues just one drug at a time; they will build a portfolio around their core competency, attempting to reduce volatility/beta to the phases of a single drug.

In Closing

Biotech is a wild west in the US, and will likely remain so for the next decade. Increasing inflows, technical innovation, and growing government support will all drive an expansion in the market. A lot of these changes will contribute to an environment where biotech companies can thrive and push the boundaries of scientific discovery and technological advancements. With the ongoing influx of capital into the industry, both from traditional sources and new investment vehicles, biotech startups will have increased access to funding for research and development, clinical trials, and commercialization efforts.

Overall, while the biotech sector in the US is poised for substantial growth in the next decade, it will remain a dynamic and unpredictable industry, characterized by rapid advancements, fierce competition, and the constant need to navigate regulatory landscapes and societal expectations.

Investing is a game of information. It’s easy to get that information for a retail business, or for a tech company - but biotech investing requires sophistication. Most investors, myself (Reasoned Speculations) included don’t touch the industry except in special cases. It’s a common acknowledgement by investors that although the approval process is relatively linear and straightforward, we just don’t understand the science well enough to justify buying in. For someone with a background in biotech - or just someone smarter than me, it’s a low bar - you might be able to glean some more insight than the rest of us. And even if you’re only right 51% of the time; make that bet enough times and you’ll earn all the money you’ll need.

Assumption Drivers (for Reference):

The Current Status of Drug Discovery and Development as Originated in United States Academia: The Influence of Industrial and Academic Collaboration on Drug Discovery and Development

Time and Success Rate of Pharmaceutical R&D

This piece is written in collaboration with Reasoned Speculations, an industry-agnostic professional investor. RS has been investing for five years now, and occasionally writes up investments publicly under his substack. He typically promises he’ll get back to writing and vanishes for another month or two. It’s been about that long, so subscribe to catch his next post!

This piece is 38/50 from my 50 days of writing series. Subscribe to hear about new posts.

References

White House: Fact Sheet - President Biden to Launch a National Biotechnology and Biomanufacturing Initiative. Retrieved from: https://www.whitehouse.gov/briefing-room/statements-releases/2022/09/12/fact-sheet-president-biden-to-launch-a-national-biotechnology-and-biomanufacturing-initiative/

Ascendia Pharmaceuticals: Notes from a CDMO - Drug Formulation Development Process. Retrieved from: https://landing.ascendiapharma.com/hubfs/documents/Drug-Formulation-Development-Process-Notes-from-a-CDMO.pdf?utm_campaign=Downloadable%20Asset%3A%20Notes%20from%20a%20CDMO

Aishwarya Doing Things: A Primer on Preclinical ToxPath Studies. Retrieved from: https://www.aishwaryadoingthings.com/a-primer-on-preclinical-toxpath-studies

National Center for Biotechnology Information (NCBI): Challenges in the Development of New Drugs: Approaches and Strategies. Retrieved from: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6226120/#:~:text=The%20success%20rate%20of%20each,%25%20(Figure%20%E2%80%8B1)

Knowledge Portalia: R&D Time and Success Rate. Retrieved from: https://www.knowledgeportalia.org/r-d-time-and-success-rate

Nature Biotechnology: Evaluating the Reproducibility of Biomedical Research. Retrieved from: https://www.nature.com/articles/s41587-022-01496-8