05/02/2023

Has Pathology Followed In The Footsteps of Radiology?

answering the question 10 years later

Pathology, the study of disease, began to emerge as a distinct field in the late 19th century. The first medical school department of pathology was established in 1852 at the University of Pennsylvania, and in 1866, the first medical journal devoted entirely to pathology, the Journal of Pathology and Bacteriology, was founded.

Radiology, on the other hand, emerged as a distinct medical specialty in the early 20th century, with the discovery of X-rays by Wilhelm Conrad Röntgen in 1895. Röntgen's discovery led to the rapid development of the field of radiology, which focused on the use of X-rays and other imaging technologies to diagnose and treat disease.

So, in terms of their emergence as distinct fields of medicine, pathology predates radiology by several decades. However, both fields have made significant contributions to the understanding and treatment of disease over the past century.

Exactly 10 years ago in 2013, a piece in Healthcare Innovation examined if pathology will follow in the footsteps of radiology. At the time, pathology had been identified as a potential area for digital image management. Although pathology predates radiology as fundamental fields, radiology had an earlier switch from film to digital images. The question then (and now) remains – will the transition for pathology be similar, and if there are lessons that can be learned from radiology’s experience.

Below, I will try to answer that question on the 10 year anniversary of the paper.

Evolution of Radiology

Let's examine the evolution of Radiology as an example. During the early days of PACS (picture archiving and communication system), standalone systems were the norm. The development was divided between specialty vendors like AT&T, and imaging equipment vendors such as Philips, GE, and Siemens. Later, film companies like Agfa, Fuji, and Kodak joined the fray as they recognized the potential impact on their film business.

Interestingly, most information systems companies were notably absent during this time. As radiology information systems (RIS) began to shift from film management to workflow management, the concept of an RIS-centric PACS emerged. Eventually, companies like McKesson and Cerner also became active players in the PACS arena.

As of 2013, the radiology market roughly split between imaging equipment companies and healthcare IT companies. A key factor that separates these companies is their ability to generate images. Imaging equipment companies have an inherent advantage in this area, which gives them an edge in advanced image processing. In contrast, most IT companies rely on third-party providers like TeraRecon and Vital Imaging (now part of Toshiba) for such technology.

During the evolution of RIS-PACS technology, companies like GE and Cerner formed partnerships to avoid competing with each other. However, most of these relationships dissolved when both sides realized the competitive advantage of offering a combined product. As a result, Siemens acquired SMS, GE acquired IDX, Philips acquired Xiris, and Fuji acquired Empiric. However, the expertise in image construction and manipulation remains a critical component of PACS, which continues to give imaging equipment companies an advantage in some respects.

Radiology workflow has become increasingly complex with the growing demand for medical imaging. Radiology departments are using new and innovative ways to improve operational efficiency, patient and staff experience, and ultimately outcomes. Radiology workflow is a complex web of separate workflows, each of which is susceptible to delays, variability, and gaps in communication. Managing such a complex system requires a clear view of the bigger picture and a deep understanding of the daily challenges of all the individual stakeholders involved. COVID-19 has added to the challenge, with certain imaging procedures declining, causing significant patient backlogs. However, radiology services have adapted by finding new ways of connecting people, data, and technology.

Digitization, virtualization, and integration now help create one seamless radiology workflow centered around the patient, for improved efficiency and quality of care. Examples include digital engagement that keeps patients safe and helps prevent no-shows, and workflow automation that assists staff in getting images first-time right. Another example is cloud-based imaging that allows radiologists to read images from anywhere, reducing turnaround times and increasing efficiency. Virtual imaging consultations and virtual tumor boards are other examples that allow physicians to collaborate and make more informed treatment decisions. By embracing digital tools, radiology departments can optimize their workflow, improve patient outcomes, and deliver high-quality care in a cost-effective and efficient manner.

Parallels with Pathology

I would argue that pathology is neck-and-neck with radiology today.

As of 2013, multiple Lab Information System (LIS) vendors, such as Cerner and Sunquest, focused on managing the reporting process for pathology studies, but they hadn’t ventured into the image acquisition field because pathology reports were generated by reviewing slides.

In contrast, various microscope vendors, including Leica, Olympus, and some new players like Aperio, Omnyx, and Philips, were competing for the Digital Pathology acquisition and management business, with the goal of automating the acquisition, management, and manipulation of digitized slides.

FYI, the LIS in pathology is similar to the RIS in radiology, while the Digital Pathology systems are similar to a PACS. There’s little overlap between the two, similar to when RIS and PACS were separate systems in Radiology. LIS vendors were uncertain about the digital pathology system vendors, as it would make sense for them to evolve backward into the LIS functionality, much like RIS vendors eyed PACS vendors with uncertainty when they began to develop their RIS.

In 2013, the integration Integrating these digital acquisition systems and LIS functionality would certainly be beneficial. It was said that LIS vendors would likely follow the same path as Radiology and evolve into this space. However, the acquisition technology was said to be the "secret sauce," as it has been in Radiology, favoring the leading acquisition vendors. Pathology vendors had the chance to learn from Radiology's evolution and avoid some of the pitfalls that hindered RIS-PACS integration.

Fortunately, the healthcare landscape is different now, with more favorable technology integration standards due to healthcare reform. This has resulted in a more open environment for Pathology to achieve better outcomes – which was also predicted in the article 10 years ago.

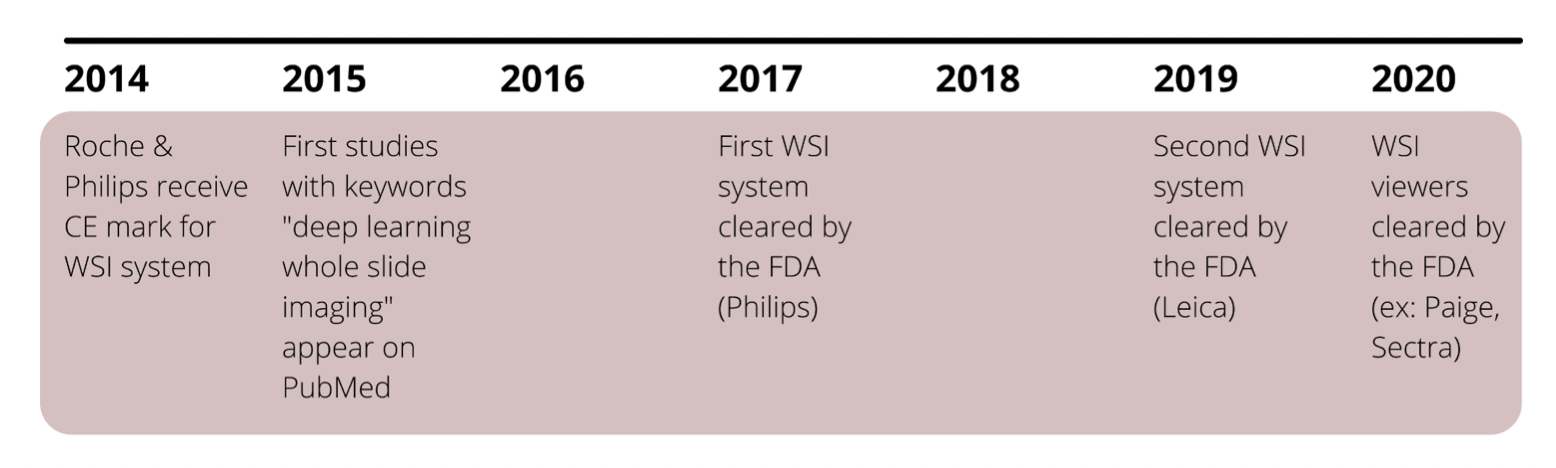

In 2015, the first research using deep learning to analyze WSI (Whole Slide Image) data started appearing. The FDA approved the first ever WSI system produced by Philips for primary diagnosis in 2017, with a second approval for Leica in 2019. While more are expected, it is evident that WSI systems are still in their infancy, especially because the FDA is formulating its own evaluation criteria. It also is apparent that, in order to support an AI ecosystem, digitization and WSI system adoption rates must eventually reach critical mass.

Evolution of Digital Pathology since 2013

Today, the status of digital pathology IMS (Image Management System) integration with LIS varies depending on the specific implementation and vendor involved. Generally speaking, some digital pathology systems are integrated with LIS, while others are not.

In some cases, LIS vendors have partnered with digital pathology vendors to provide integration between their respective systems. For example, Sunquest, a leading LIS vendor, has partnered with Philips, a major digital pathology vendor, to offer an integrated solution for pathology labs. Similarly, Cerner, another LIS vendor, has partnered with Leica, a digital pathology vendor, to offer an integrated solution.

However, not all LIS vendors have ventured into the digital pathology space, and not all digital pathology vendors have focused on integration with LIS. Some digital pathology vendors have developed their own LIS-like functionality to manage the reporting process, while others have focused solely on image acquisition and management.

By integrating with the LIS, a digital case can be generated that consolidates the pathologist's annotations, interpretations, and quantitative tissue analysis results into one accessible system.

An optimal workflow would be automated, where slide scanning would initiate the retrieval of patient and case information from the LIS.

Overall, the status of digital pathology IMS integration with LIS is evolving, with some vendors offering integrated solutions and others focusing on standalone systems. As with any evolving technology space, it is likely that the landscape will continue to shift as vendors adapt to changing market needs and new integration opportunities arise.

Market

The digital pathology (AI enabling) market is now more clearly segmented into hardware (scanners), software (IMS / platform), and services.

The software industry is witnessing more partnerships for expanding into new geographies, with most new adopter budgets still focused on scanners and AI-enabled platforms. According to a report by Signify Research, successful AI integration will be crucial, and enterprise imaging vendors will play a significant role in partnerships.

The US market is expected to experience double-digit growth due to accelerated adoption, with the scanner segment predicted to see the most growth initially, followed by software as budget becomes available and IT becomes a priority.

Platform growth is expected to be driven by integration and customization. There is also strong interest among life sciences organizations in using Real World Data (RWD) for digital pathology and developing companion diagnostics.

Emerging adjacent technologies

Spatial biology and multiplex imaging are emerging trends for exploration, and multimodal data, such as images paired with clinical IT information, is highly valued. The wider RWD market is moving towards a platform-centric approach.

Reports also see the RWD push encouraging standardization of DICOM. In the pharma space, growth is expected to emerge as mid-small biotechs and Contract Research Organizations (CROs) start adopting, while big pharma is expected to consolidate and stop operating in silos.

M&A

The M&A landscape in digital pathology has been active over the last year or so. In 2021, some of the notable M&A deals in the industry included Royal Philips' acquisition of BioPharma Services, OptraSCAN's acquisition of 3DHISTECH, and Inspirata's acquisition of Omnyx.

Additionally, at Proscia, we raised a Series C funding round to expand our digital pathology platform, along with OEM partnerships with Siemens and Agilent for global distribution. PathAI and Paige.AI raised their Series C funding rounds in 2020 to develop their technologies. PathAI bought a lab – Poplar to enter clinical diagnostics last year, while Fujifilm bought Inspirata and Paige entered a partnership with Microsoft, indicating a trend of consolidation and investment in hardware, technology, and platforms.

Applications in biopharma for research will likely see exponential adoption, compared to diagnostics in clinical due to regulatory barriers. However, the market’s need and push for tools in clinical decision support and AI-enablement in all parts of the lab might help push adoption in diagnostics and clinical labs.

Future Directions

I also have a hunch that similar to radiology, 3D and spatial pathology companies will continue to rise. Like in radiology, the imaging hardware takes the image directly to an image management system – pathology might have the same with lightsheet microscopy. Alpenglow Biosciences out of Seattle is leading the cause in this area. I also see responsible and explainable AI initiatives rising with AI tools in deployment with image analysis with companies like PredxBio. In terms of AI, clinical decision support is not common currently, but is definitely used in research environments. Common use cases in research include automatic quality control, prostate and breast cancer detection, as the most common.

Within research, biopharma and CROs are the targets for digital / computational pathology use. Currently, it is most widely used in preclinical for toxicopathology and safety needs due to data integrity guidelines for the FDA (GLP/GMP), but is expanding into clinical trials with the most important use case being the establishment of criteria.

Read more on my views regarding 3D imaging in digital and computational pathology here in Digital Pathology 2.0 and my views on lightsheet microscopy in Digital Pathology 3.0.

Interoperability, speed, unstructured data, training & education, and regulatory compliance remain the biggest challenges in the implementation of digital pathology systems, and its pipeline into computational (AI adoption).

This piece is 32/50 from my 50 days of writing series. Subscribe to hear about new posts.

References

2013 paper from Healthcare Innovation

https://www.hcinnovationgroup.com/clinical-it/clinical-documentation/blog/13019377/will-pathology-follow-in-the-footsteps-of-radiologyPhilips on radiology innovation

https://www.philips.com/a-w/about/news/archive/blogs/innovation-matters/2020/20201124-seven-innovations-in-radiology-workflow-that-are-improving-efficiency-and-quality-of-care.htmlThe use of digital pathology and image analysis in clinical trials

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6463857/Signify Research

https://www.signifyresearch.net/reports/digital-pathology/IHE PaLM

https://www.ihe.net/uploadedFiles/Documents/PaLM/IHE_PaLM_Suppl_APSR.pdf